All Categories

Featured

Table of Contents

No issue when you pass away, your heirs will certainly obtain the fatality benefit you want them to have, as long as you paid the premiums. Final expense insurance policy might not be adequate to cover everything but it can aid your liked ones pay a minimum of some bills directly. These might be expenses they would certainly otherwise have a tough time taking care of.

Last expenditure insurance policy can alleviate the worries of your household participants because it supplies them with money they may require to pay costs connected to your death. It can be a welcome choice for people who can not get any type of other insurance coverage due to their age or health however wish to alleviate some economic worries for enjoyed ones.

For extra on ensured issue policies, including just how life insurance policy firms can pay for to provide them, read our piece on guaranteed problem life insurance policy. There's a 3rd type of last expense insurance policy. It's a graded benefit plan with a partial waiting period. This sort of plan could pay 30% to 40% of the survivor benefit if the insured passes away during the initial year the plan is in pressure.

United Of Omaha Final Expense

If the insured dies after those initial two years, then the plan would pay 100% of the survivor benefit. If you have wellness conditions that are only semi-serious, you might receive a graded benefit plan as opposed to a guaranteed problem policy. These wellness conditions include entering remission from cancer cells in the last 24 months, coronary infarction, or treatment for alcohol or substance abuse in the last 24 months.

Keeping that policy, you'll need to wait at the very least two years for any kind of protection. No single insurer supplies the most effective last cost insurance coverage option, claims Martin. It is essential to get deals from several insurance provider to locate the ones that watch your wellness most favorably. Those business will likely supply you the very best prices.

Final Expense Carriers

Also if you have a less-than-ideal solution to a wellness concern, it does not mean every business will certainly reject you. Some might offer you instant coverage with greater premiums, a graded advantage plan, or an ensured problem policy. Investopedia/ Lara Antal If you have considerable financial savings, financial investments, and regular life insurance coverage, then you most likely do not need last expenditure insurance.

Easy to qualify. Requires responses to medical questions but no medical examination. Premiums never enhance. Survivor benefit can not be reduced unless you obtain versus money worth or demand sped up death advantages throughout your lifetime. Successors can make use of death benefit for any kind of function. Fatality benefit is ensured as long as costs are paid and you don't have a term policy.

If he purchases the most pricey plan with the $345 monthly costs, after two years he will certainly have paid $8,280 in costs. His beneficiaries will come out ahead if he dies between the initial day of year three (when the waiting period ends) and the end of year six, when the premiums paid will certainly have to do with equal to the fatality benefit.

They may not also want to get a final expense policy, according to Sabo. Sabo claims that a 68-year-old non-smoking male in California could get a $25,000 ensured global life plan for concerning $88 per month.

Surefire universal life, like whole life, does not end as long as you get a policy that covers the rest of your life. You can purchase a policy that will cover you to age 121 for maximum defense, or to age 100, or to a more youthful age if you're attempting to save money and do not need protection after, say, age 90.

Burial Insurance Cost

Anything. An insured might have intended that it be made use of to pay for points like a funeral, flowers, medical costs, or nursing home prices. Nonetheless, the money will belong to the recipient, that can opt to use it for something else, such as bank card debt or a nest egg.

Most sites supplying it have calculators that can provide you an idea of expense. For illustratory functions, a 65 year-old female seeking a $10,000 face amount and no waiting duration might pay regarding $41 monthly. For a guaranteed approval plan, they would certainly pay $51. A 65 year-old male seeking a $10,000 face quantity and no waiting period might pay regarding $54 monthly, and $66 for assured acceptance.

If you have adequate cash established apart to cover the expenses that need to be satisfied after you pass away, then you do not require it. If you don't have cash for these and various other linked costs, or normal insurance coverage that might cover aid them, last expenditure insurance might be a real advantage to your family members.

Final Expense Telesales From Home

It can be utilized to spend for the numerous, conventional services they want to have, such as a funeral or memorial solution. Financial expenditure insurance is easy to certify for and inexpensive. Protection amounts array from $2,000 approximately $35,000. It isn't a big quantity yet the benefit can be a blessing for member of the family without the financial wherewithal to fulfill the expenses related to your passing.

Last Cost Insurance Coverage (also known as funeral service or interment insurance) is meant to cover the bills that your enjoyed ones will face after you die, consisting of funeral expenditures and clinical expenses. At Final Cost Direct, we represent our clients with their benefit in mind, everyday. Our group is below to answer your questions concerning final cost insurance coverage.

It seems important to save money to use for your final expenditures. You may have to reach right into that cash before you pass away. There's no means to understand without a doubt due to the fact that conditions, injuries, and ailments are uncertain. Clinical financial obligation is the # 1 reason of personal bankruptcy in this country.

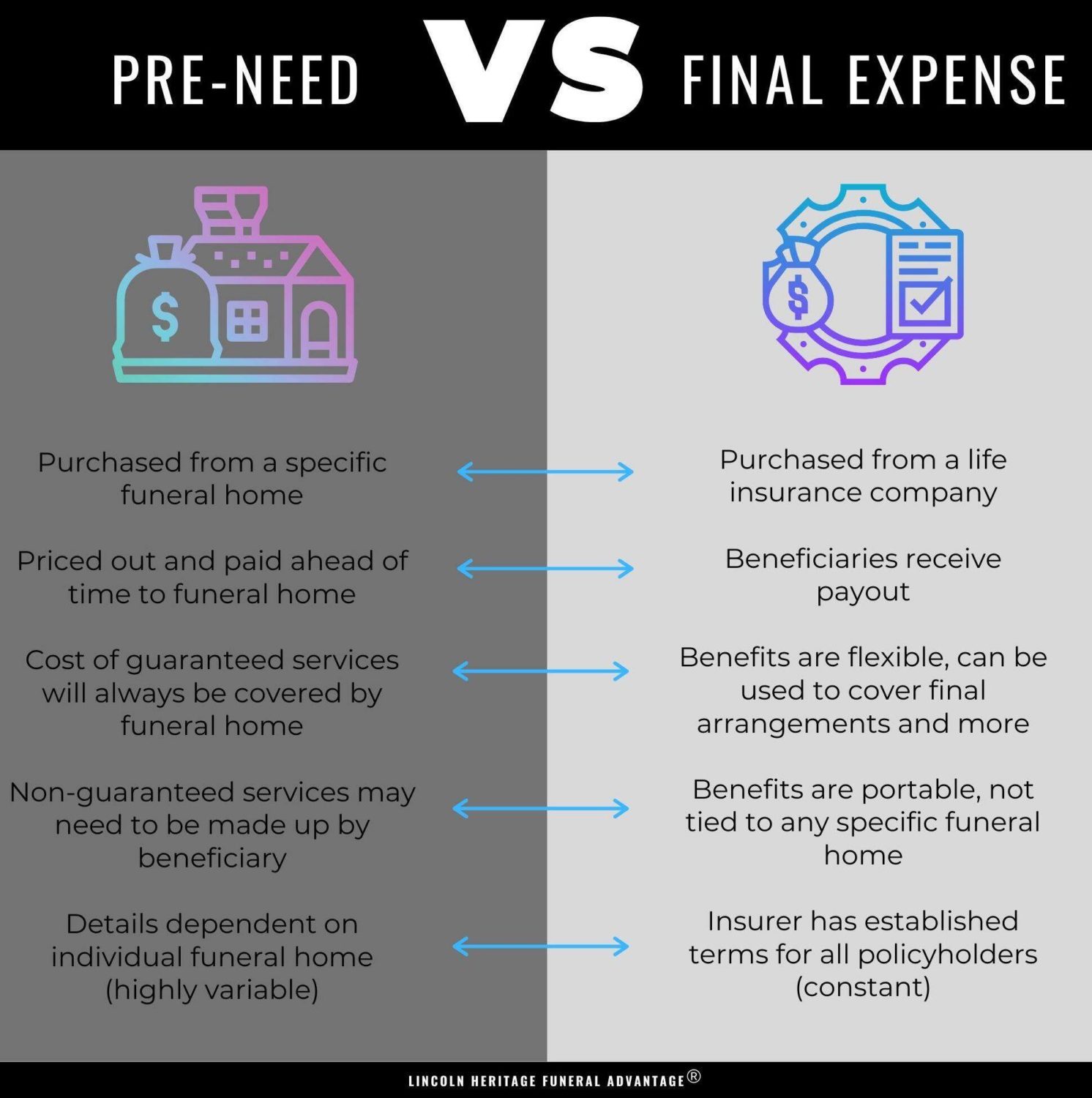

With pre-need insurance coverage, the payment goes directly to the funeral home.

We suggest obtaining three final expenditure quotes. Prices aren't advertised online, so you'll need to call the funeral home straight.

Highest Paying Funeral Cover

You can do this in 4 easy steps: To estimate your household's costs, take the amount of a normal month's expenses (include utilities, vehicle costs, home repayments, food and transport, insurance costs, and so on) and increase the total amount by 3. This will certainly be about what your family members needs to make it through for a couple of months.

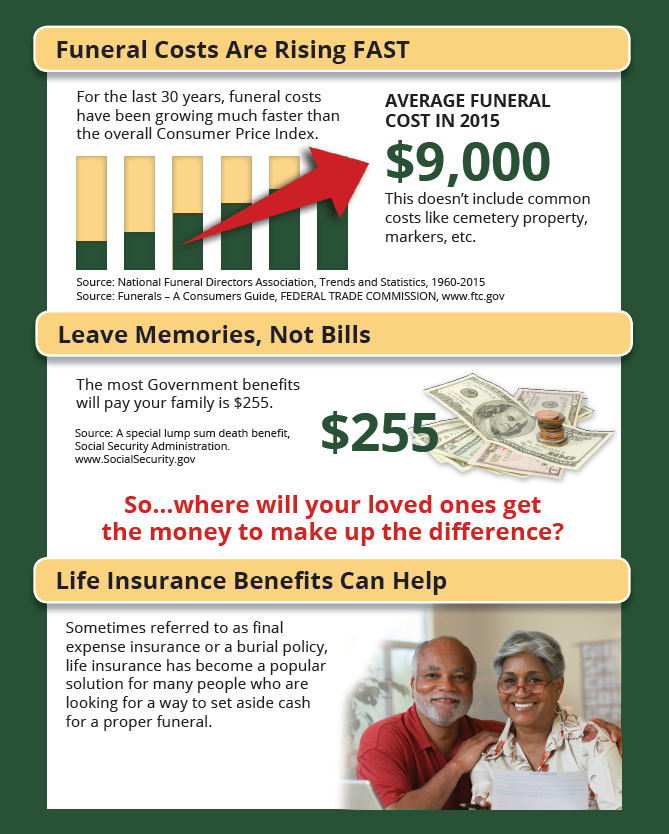

Funeral expenses are dictated by what kind of services you choose. See this list to assist obtain a precise quote of the regular funeral-related costs. We can presume, presently, that your expenses will certainly balance $10,000. Next off, add the above numbers together. In this case, it's $9,000 (household expenses) + $10,000 (funeral service costs) = $19,000.

There's an inflation variable that differs for guys and women. This variable depends upon your age variety. As an example, for guys ages 63-65, the multiplier is 1.83. You 'd multiply 1.83 by the total you had from Action 3 for the complete approximated price. Contrast and buyfinal cost You can try to make funeral arrangements through your will, but don't expect reputable results.

Opportunities are slim that your will certainly would offer any kind of prompt help with your last expenditures. You might wonder if you require last cost insurance policy if you're an expert.

Best Final Expense

However, as we've mentioned, the average price for a funeral and funeral is around $7,000 $8,000. Even if you get Experts' advantages, there might still be a big sum left over. With a flexible last cost policy, you can complete the voids. Unfortunately, Medicaid and Social Safety advantages barely start to cover final expenses.

Latest Posts

Burial Insurance Pro

The Assurance Group Final Expense

Cost Of Final Expense Insurance